Embark on a captivating journey into the realm of economics with our comprehensive Economics Chapter 3 Test Answer Key. This guide unveils the fundamental principles, concepts, and theories that shape the economic landscape, providing you with the knowledge and insights to excel in your studies and grasp the complexities of economic decision-making.

Delve into the interplay of supply and demand, explore the diverse market structures, unravel the intricacies of elasticity and consumer behavior, and analyze the factors of production and cost. Along the way, you’ll gain a profound understanding of market failures and the role of government intervention in correcting these inefficiencies.

Economics: Fundamental Principles: Economics Chapter 3 Test Answer Key

Economics is the study of how individuals, societies, and economies make choices in the face of scarcity. It involves analyzing how resources are allocated, goods and services are produced, and wealth is distributed.

The fundamental principles of economics include:

- Scarcity: Resources are limited, while human wants are unlimited.

- Opportunity cost: Every choice involves giving up something else.

- Rationality: Individuals make decisions that they believe will maximize their benefit.

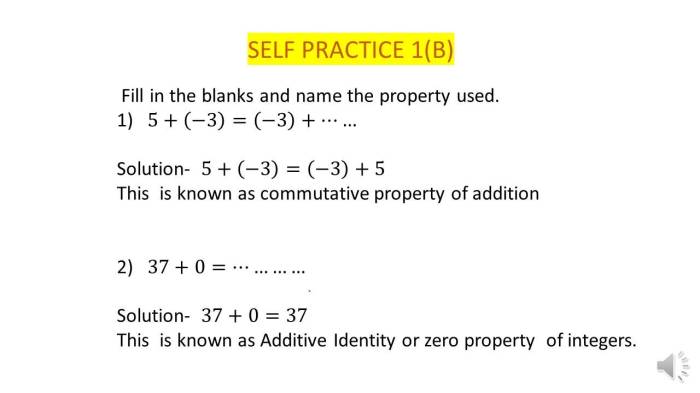

- Marginal analysis: Economic decisions are made by comparing the additional benefits and costs of a particular action.

Supply and Demand

Supply and demand are the two fundamental forces that determine the prices and quantities of goods and services in a market economy.

Supply refers to the amount of a good or service that producers are willing and able to sell at a given price.

Demand refers to the amount of a good or service that consumers are willing and able to buy at a given price.

The equilibrium price is the price at which the quantity supplied equals the quantity demanded.

Elasticity and Consumer Behavior

Elasticity measures the responsiveness of demand or supply to changes in price or other factors.

Price elasticity of demand measures the percentage change in quantity demanded in response to a 1% change in price.

Income elasticity of demand measures the percentage change in quantity demanded in response to a 1% change in income.

Factors that influence consumer behavior include:

- Income

- Prices

- Preferences

- Expectations

Production and Cost Analysis, Economics chapter 3 test answer key

Production involves the transformation of inputs (resources) into outputs (goods and services).

The production function describes the relationship between inputs and outputs.

Total cost is the sum of all costs incurred in the production process.

Marginal cost is the additional cost of producing one more unit of output.

Graphical representations of production and cost curves help analyze the relationship between inputs, outputs, and costs.

Market Structures

Market structure refers to the number and size of firms in a market, as well as the barriers to entry and exit.

Types of market structures include:

- Perfect competition

- Monopoly

- Oligopoly

- Monopolistic competition

Market structure influences market outcomes such as price, output, and consumer welfare.

Essential FAQs

What is the fundamental principle of economics?

Economics is based on the principle of scarcity, which states that resources are limited while human wants are unlimited.

How does supply and demand affect market equilibrium?

Supply and demand interact to determine the equilibrium price and quantity in a market, where the quantity supplied equals the quantity demanded.

What are the different types of market structures?

Common market structures include perfect competition, monopoly, monopolistic competition, and oligopoly, each with distinct characteristics and behaviors.

What is elasticity and how does it impact consumer behavior?

Elasticity measures the responsiveness of demand or supply to changes in price or other factors, influencing consumer behavior and market outcomes.

What role does government intervention play in correcting market failures?

Government intervention can address market failures, such as externalities, monopolies, and public goods, by implementing policies like regulations, taxes, and subsidies.